Running advertisements on social networking sites such as Facebook is a highly effective way of reaching a larger audience and promoting your brand or business. However, advertising on Facebook also means understanding taxation policies and calculating taxes for your ad expenses. This can be a complicated process, but with the help of Facebook Ads Manager, you can easily calculate the tax for your advertisements. In this article, we'll walk you through all the steps you need to take to successfully calculate tax in Facebook Ads Manager.

Understanding Facebook Ads Manager and Taxation

Facebook Ads Manager is an online tool that has revolutionized the way businesses create and manage their advertising campaigns on Facebook and Instagram. With its user-friendly interface and advanced targeting options, it has become a go-to platform for businesses looking to expand their reach and grow their customer base.

However, with great power comes great responsibility, and one of the responsibilities that businesses need to be aware of when using Facebook Ads Manager is taxation. In this article, we'll explore the basics of Facebook Ads Manager and taxation and provide you with a comprehensive guide on how to calculate taxes in Facebook Ads Manager.

An Overview of Facebook Ads Manager

Facebook Ads Manager is an online tool that allows businesses to create, run, and manage advertisements on Facebook and Instagram. The tool provides a comprehensive range of advertising options, including audience targeting, ad placement, and budget management. With Facebook Ads Manager, businesses can create ads that are tailored to their target audience, ensuring that their message is seen by the right people at the right time.

One of the key features of Facebook Ads Manager is its advanced targeting options. With Facebook's vast user data, businesses can target their ads based on a variety of factors, including age, gender, location, interests, and behaviors. This level of targeting ensures that businesses are only reaching the people who are most likely to be interested in their products or services, improving the effectiveness of their advertising campaigns.

How Taxes Apply to Facebook Ads

Whenever you spend money on Facebook ads, you're considered a customer of their ad platform, and Facebook charges taxes on the ad spend. The taxes are based on the ad's objective, targeting criteria, and the jurisdiction your ad is being served in. It's important to note that the tax rate varies by country.

For example, if you're running a Facebook ad campaign in the United States, you may be subject to sales tax or use tax, depending on the state where your ad is being served. If you're running an ad campaign in Europe, you may be subject to value-added tax (VAT), which varies by country.

Calculating taxes in Facebook Ads Manager can be a complex process, as it involves understanding the tax laws in your jurisdiction and the various tax rates that apply to your ad spend. However, Facebook provides businesses with tools and resources to help them calculate and pay their taxes, ensuring that they stay compliant with local tax laws.

In conclusion, understanding Facebook Ads Manager and taxation is essential for businesses looking to expand their reach and grow their customer base through advertising on Facebook and Instagram. By familiarizing yourself with the basics of Facebook Ads Manager and taxation, you can ensure that your advertising campaigns are effective and compliant with local tax laws.

Setting Up Your Facebook Ads Account for Tax Calculation

Before you can start calculating taxes for your Facebook ad spend, you need to ensure that your account is set up correctly. Below are the steps to follow:

Adding Your Business Information

The first step is to ensure that your business information is correct and up to date. This includes your business name, address, and other relevant information. You can access this by going to the "Settings" tab in Facebook Ads Manager and clicking on "Business Info".

Selecting Your Tax Status

The next step is to select your tax status. Do this by going to the "Settings" tab in Facebook Ads Manager and clicking on "Tax". From the drop-down menu, select your tax status based on your business or residency status in the country where your ad will be served.

Inputting Your Tax Identification Number

Once you've selected your tax status, you'll need to input your tax identification number (TIN) if applicable. This is a unique identification number used for tax purposes. If you don't have a TIN, consult with the appropriate tax authorities in your country.

Determining Tax Rates for Your Facebook Ads

After setting up your Facebook Ads account for tax calculation, the next step is to determine the tax rates for your ads. Here's what you need to know:

Understanding Tax Rates by Country

Federal, state, and local governments impose taxes on ad spend, and tax rates vary by country. In the United States, for example, the federal government imposes a 5% tax on ad spend, while some states may impose additional taxes. In Canada, the government charges a 5% Goods and Services Tax (GST), and some provinces have additional taxes.

Tax Rates for Different Types of Ads

The tax rates also vary depending on the type of ad you're running. For instance, some ads, such as charitable ads or political ads, may be exempt from taxes. Also, the type of product or service you're promoting and the industry you're involved in might influence the tax rate for your ads.

Tax Exemptions and Special Cases

There might be certain exemptions or special cases where you won't be required to pay tax. For example, if your business is registered as a non-profit organization, you might be exempt from paying taxes on some types of ads. It's essential to consult with the relevant tax authorities in your country to determine if you're eligible for any exemptions or special treatments.

Calculating Tax on Your Facebook Ad Spend

Now that you know how to set up your Facebook Ads account for tax calculation and understand the tax rates, the final step is to calculate the tax on your ad spend. Here's how:

How Facebook Calculates Tax on Ad Spend

Facebook calculates the tax on your ad spend based on the jurisdiction your ad is being served in and the tax rate for that jurisdiction. The tax amount is added to your ad amount to give you the total payable amount. Facebook will break down the amount charged, so you can see the amount of tax charged separately.

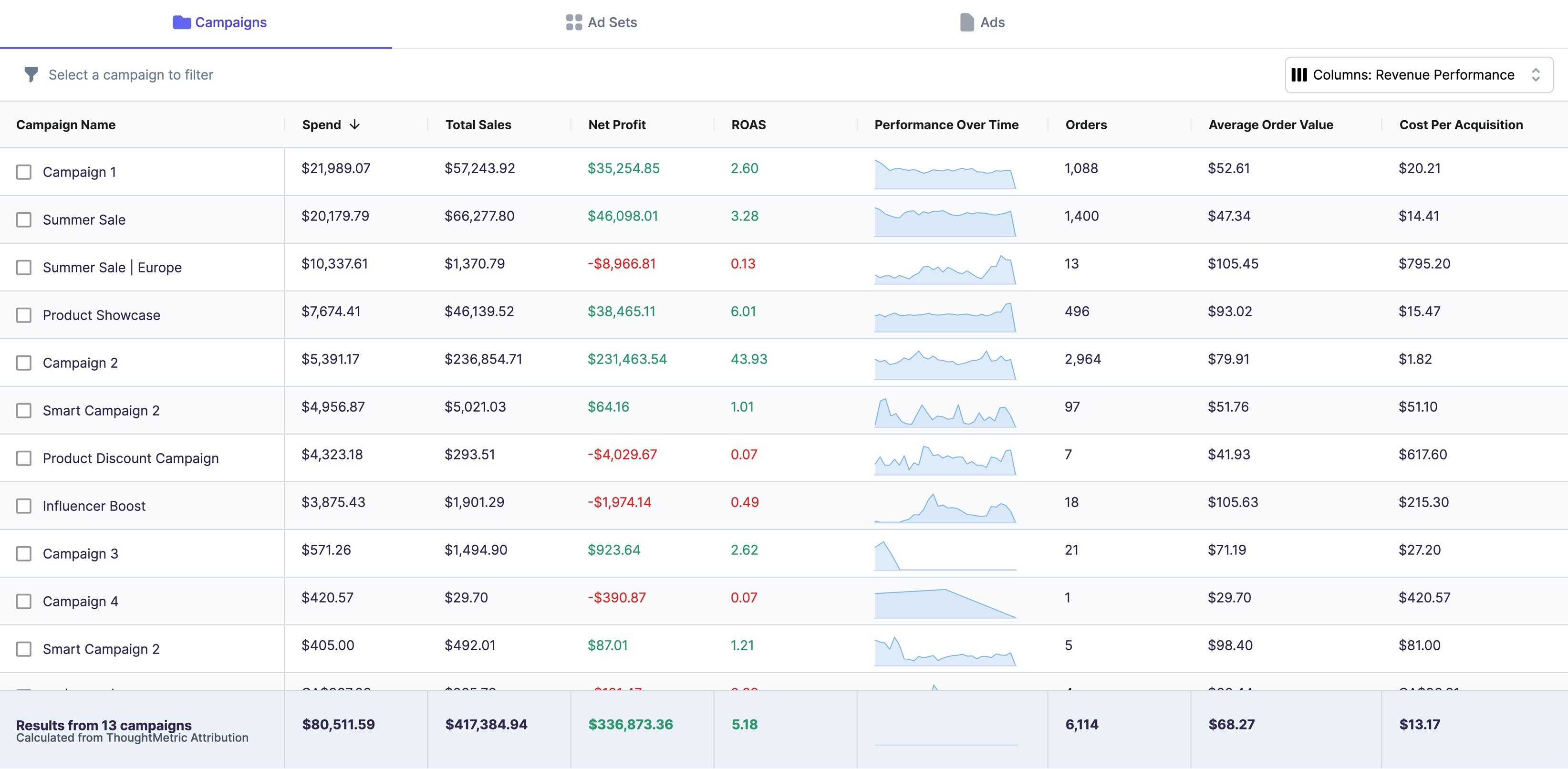

Viewing Your Tax Amount in Ads Manager

You can view the tax amount charged on your ad spend by going to the "Billing" tab in Facebook Ads Manager. Here, you can view the total spent, the amount of tax charged, and the total payable amount.

Adjusting Your Ad Budget to Account for Taxes

It's important to account for taxes when setting your ad budget. This will help you avoid overspending and ensure that you have enough budget to cover for the tax charged. Keep in mind that taxes are charged on top of your ad spend, so it's wise to include a buffer in your ad budget.

Conclusion

Calculating tax on your Facebook ad spend might seem overwhelming, but with the help of Facebook Ads Manager, the process becomes straightforward and manageable. By following the steps outlined in this article, you can easily set up your account for tax calculation, determine the applicable tax rates, and calculate the tax on your ad spend. Don't forget to adjust your ad budget to account for taxes and ensure that you have enough budget to achieve your advertising objectives. Finally, it's crucial to remain informed about any changes in taxation policies that might affect your ad spend.